What I Learned Losing a Million Dollars - Jim Paul

## Metadata

- Author: **Jim Paul**

- Full Title: What I Learned Losing a Million Dollars

- Category: #books

## Highlights

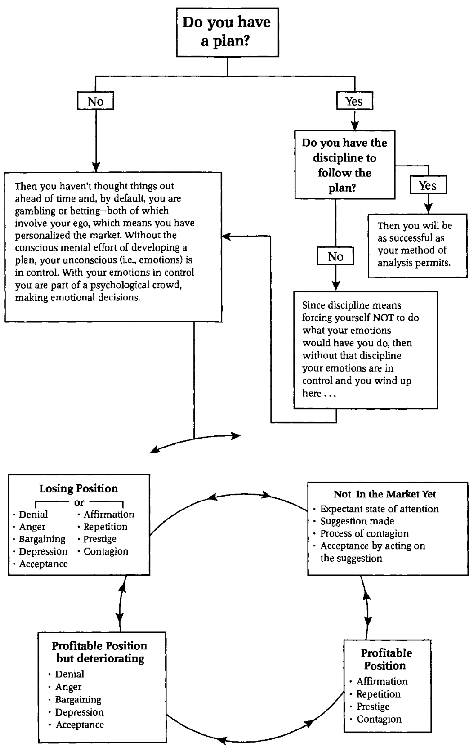

- Weak is he who allows his actions to be controlled by his emotions and strong is he who forces his actions to control his emotions.” If you’re not consciously doing the latter, then you’re unconsciously doing the former, which is precisely Le Bon’s description of the conscious personality of an individual vanishing when he enters the crowd. ([View Highlight](https://read.readwise.io/read/01j985tvj81s94a2zc5b2sxx7k))

-  ([View Highlight](https://read.readwise.io/read/01j985xweqasge4by3zkgz2zg0))

- “I haven’t met a rich technician.”[4](private://read/01j8bs2fj1k9da99zc5pjn78j3/#note_4)

Jim Rogers ([View Highlight](https://read.readwise.io/read/01j933q7680w8h46vs5depgtp9))

- “I always laugh at people who say, ‘I’ve never met a rich technician.’ I love that! It is such an arrogant, nonsensical response. I used fundamentals for nine years and then got rich as a technician.”[5](private://read/01j8bs2fj1k9da99zc5pjn78j3/#note_5)

Marty Schwartz ([View Highlight](https://read.readwise.io/read/01j933r2k3ssz1ex15vgn0kcx9))

- Not very encouraging! Okay, so maybe the key to success wasn’t whether you were a fundamentalist or a technician. I mean, I had made a lot of money using both of these methods. While I found technical analysis indispensable, there was nothing like a good fundamental situation to really make a market move. Maybe another topic would begin to reveal the pros’ secret.

“Diversify your investments.”[6](private://read/01j8bs2fj1k9da99zc5pjn78j3/#note_6)

John Templeton ([View Highlight](https://read.readwise.io/read/01j933sgqj2kpjwvs4whgbt6fk))

- All right! Now I was getting somewhere. This was striking a familiar chord. Maybe I had placed too much emphasis on the soybean oil spreads. I had too large a percentage of my capital committed to that market and that trade. Even afterwards, I was trading only one market at a time. This looked like my first lesson from the masters: diversify. Or it looked that way until I read the following:

“Diversification is a hedge for ignorance.”[7](private://read/01j8bs2fj1k9da99zc5pjn78j3/#note_7)

William O’Neil ([View Highlight](https://read.readwise.io/read/01j933ttbwcbrwpxxf5esvx9fb))

- “Concentrate your investments. If you have a harem of 40 women you never get to know any of them very well.”[8](private://read/01j8bs2fj1k9da99zc5pjn78j3/#note_8)

Warren Buffett ([View Highlight](https://read.readwise.io/read/01j933v5gxa26w1xh90fyf7vg9))

- Learning *how not to lose money* is more important than learning *how to make money*. ([View Highlight](https://read.readwise.io/read/01j934pcdrmanaf1d0y5b4aadf))

- “*Good judgment is usually the result of experience, and experience frequently the result of bad judgment*.”

Robert Lovett ([View Highlight](https://read.readwise.io/read/01j934r2jfc47gs2mzgx4rdyan))

- there are as many ways to make money in the markets as there are people in the markets, but there are relatively few ways to lose money. ([View Highlight](https://read.readwise.io/read/01j934wf4dqhtw2hwr3rtaz394))

- So between August 1983 and August 1984, I lost all of my money, went $400,000 in debt, lost my membership, my job, my Board of Governor’s seat, my Executive Committee seat and both of my parents. I lost everything that was important to me except my wife and kids. That was not a good twelve months. ([View Highlight](https://read.readwise.io/read/01j9377qvcaja4125h78yvghnh))

- People tend to regard the words *loss*, *wrong*, *bad* and *failure* as the same, and *win*, *right*, *good* and *success* as the same. For instance, we *lose* points for *wrong* answers on tests in school. Likewise, when we lose money in the market we think we must have been wrong. ([View Highlight](https://read.readwise.io/read/01j937bxsnw5dtwr19dy7dqdh9))

- Betting and gambling are suitable for discrete events but not for continuous processes. ([View Highlight](https://read.readwise.io/read/01j95njsaygkt37rj7hrmf2b0c))

- The basic distinction between the individual and the crowd is that the individual acts after reasoning, deliberation and analysis; a crowd acts on feeling, emotion and impulses. An individual will think out his opinions, whereas a crowd is swayed by emotional viewpoints rather than by reasoning. In the crowd, emotional and thoughtless opinions spread widely via imitation and contagion. ([View Highlight](https://read.readwise.io/read/01j96mzg8fk6vyqcqn8qavq0wd))

- Preoccupation with being right means you’re betting, which personalizes the market and is the root of losses due to psychological factors. Concern yourself with whether or not you have done your homework to define a set of conditions under which you will enter and exit the market, and whether or not you carry out that plan. ([View Highlight](https://read.readwise.io/read/01j980dmmyvhpjdeej2z2vdywy))

- However, from my trading and gambling experiences I have learned that the more the markets are treated as a game, the less likely you are to have losses due to psychological factors. ([View Highlight](https://read.readwise.io/read/01j980ppj0v3md9bqtz2ngyerv))

- If you’re bullish because you’re long, your decision was inductive and you will look for reasons, other people’s opinions or anything to keep you in your position — anything to keep you from looking stupid or admitting you are wrong. ([View Highlight](https://read.readwise.io/read/01j98a3fdr0sghgdhn0zejtp6c))